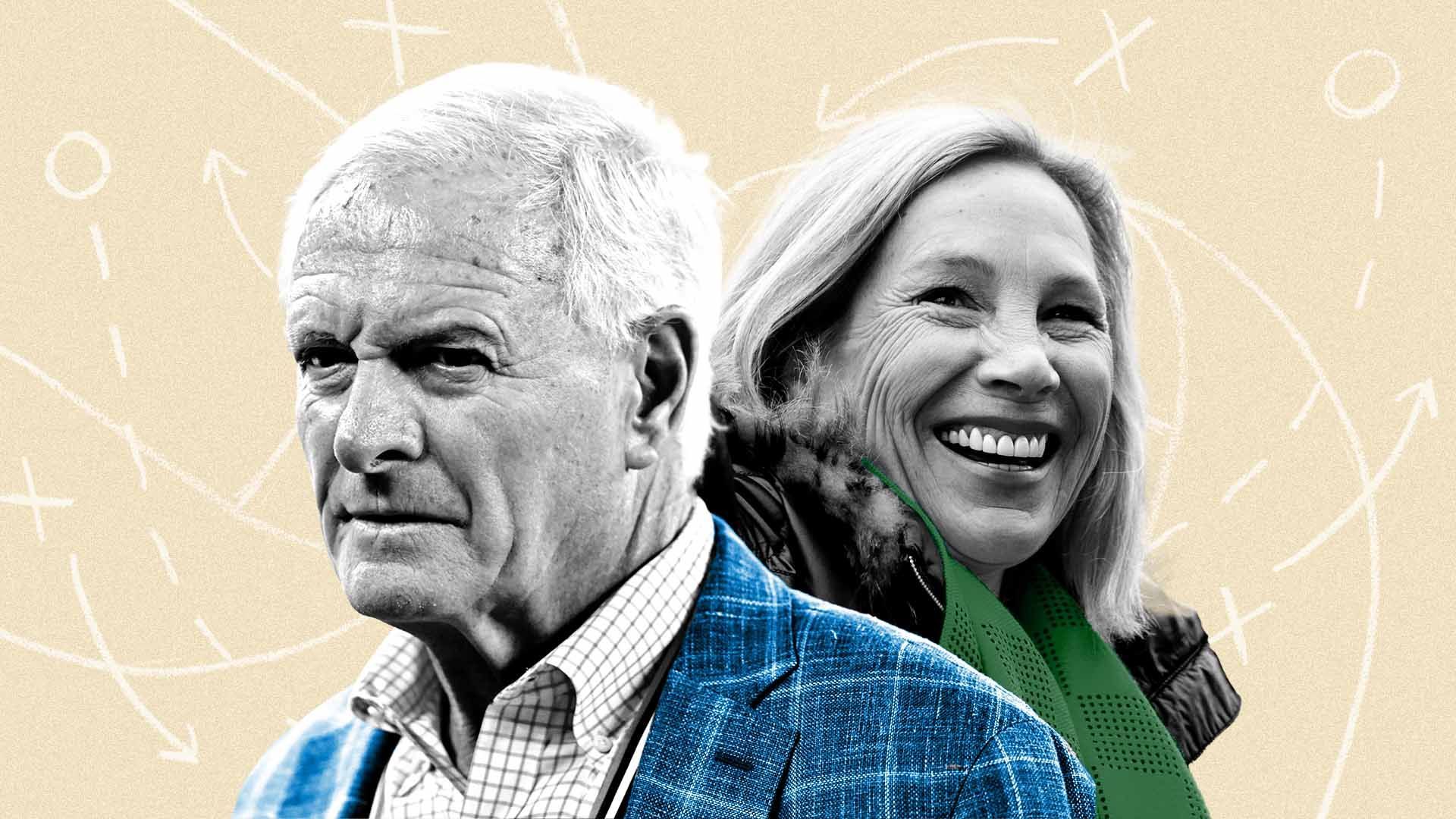

| | | | | | | | | | Axios Pro Rata | | By Dan Primack · Feb 28, 2023 | | | | | | Top of the Morning |  | | | Jimmy and Dee Haslam. Photo illustration: Sarah Grillo/Axios. Photos: Jason Miller, Jason Mowry/Icon Sportswire via Getty Images | | | | The National Basketball Association has purged itself of two toxic owners in recent years, via team sales in Los Angeles and Phoenix that garnered record valuations. Now, however, it's faced with dodgy actors on the buyside. Driving the news: Jimmy and Dee Haslam have agreed to acquire around a 25% stake in the Milwaukee Bucks at around a $3.5 billion franchise valuation, as first reported by ESPN and confirmed by Axios with multiple sources. - The seller is hedge fund manager Marc Lasry, who in 2014 partnered with private equity investor Wes Edens to buy control of the club for around $550 million. Word is that he's seeking to launch a sports-focused investment fund within Avenue Capital Group, and Bucks ownership could have caused conflicts of interest.

- Lasry and Edens currently rotate their position as NBA governor (each team only gets one), with the Haslams to assume Lasry's turn in that rotation.

- The remaining Bucks equity stakes are held by a large group of small limited partners, as is true for many NBA teams.

- Neither Lasry nor the NBA are commenting.

State of play: The agreement now goes to a subcommittee of NBA governors, which will make a recommendation on approval after doing due diligence on the new owners' financial situation, etc. - Historically, this committee has worked with rubber stamps, but there's some reason to think this time may be different.

At issue: The Haslams made their fortune on truck stops, and their flagship company has had more than its fair share of business scandal. But they're better known as owners of the Cleveland Browns football team, bought a decade ago for $1 billion. - Haslam ownership hasn't impacted the Browns' on-field fortunes, but it has changed the team's reputation in many eyes from that of lovable losers to pariahs.

- Namely by trading last year for Deshaun Watson, a quarterback sued by 25 different women for sexual harassment or assault, and then handing him a $230 million contract. Watson never faced criminal charges, but did settle almost all of the cases.

- Jimmy Haslam, in trying to defend the move, talked a lot about second chances, but also let slip: "You can say that's because he's a star quarterback. Well, of course."

The bottom line: Browns fans are faced with either cheering for a man accused of heinous acts by 25 different women — again, that number cannot be overemphasized — or finding something else to do on Sunday afternoons. - The NBA is faced with deciding if it wants a couple with dubious priorities to join its exclusive club.

|     | | | | | | The BFD |  | | | Illustration: Sarah Grillo/Axios | | | | Paratus Sciences, a drug discovery startup leveraging bat biology, raised $100 million in Series A funding. Why it's the BFD: This has been a winning week for bats, long maligned for spreading disease and general creepiness. First, there was the (still unreleased) Department of Energy report that COVID-19 was more likely to have been caused by a lab leak than by zoonotic spillover. And now this big-money effort to study the flying mammals for the purpose of developing human therapeutics in areas like inflammation. Investors include Polaris Partners, Arch Venture Partners, ClavystBio, EcoR1 Capital, Leaps by Bayer and Alexandria Venture Investments. - Amir Nashat, a longtime Polaris partner, is serving as Paratus CEO. Company president Phil Ferro is the former director for countering biological threats on the National Security Council.

The bottom line: "In addition to powered flight, bats have evolved the ability to control inflammation, tolerate viral infection, resist cancer, accept extreme diets, and live exceptionally long lives for a mammal of their size. However, the elusive lifestyle of bats coupled with a lack of scientific tools and reagents has made the study of these extraordinary animals difficult and slow going." — Paratus website |     | | | | | | Venture Capital Deals | | • Bitwise Industries, a Fresno, Calif.-based tech training company, raised $80m. Kapor Center and Motley Fool co-led, and were joined by Goldman Sachs and Citibank. https://axios.link/3IFw6wg 🚑 CodaMetrix, a Boston-based health care revenue cycle services startup, raised $55m in Series A funding, as first reported by Axios Pro. SignalFire led, and was joined by Frist Cressey Ventures, Martin Ventures, Yale Medicine, University of Colorado Healthcare Innovation Fund, and Mass General Brigham. • Bonusly, a Boulder, Colo.-based employee recognition and rewards platform, raised $18.9m in Series B funding. Ankona Capital led, and was joined by FirstMark Capital, Access Venture Partners, and Next Frontier Capital. www.bonus.ly • Andrena, a New York-based ISP, raised $15m in Series A funding, as first reported by Axios Pro. Dragonfly Capital led, and was joined by Blockchange Ventures, Moonshot Research, EV3 and insiders Afore Capital, FJ Labs, Castle Island Ventures, Chaos Ventures, KohFounders and J Ventures. https://axios.link/41xcKly • Gable, an SF-based remote work management platform, raised $12m in Series A funding. SemperVirens and Foundation Capital co-led, and were joined by Tishman Speyer Ventures, Ulu Ventures and January Ventures. https://axios.link/3IDR2nk • SepPure, a Singapore-based developer of industrial chemical membrane tech, raised $12m in Series A funding. SOSV led, and was joined by Anji Microelectronics, RealTech Fund, Seeds Capital and EPS Ventures. www.seppure.com • Marco, a Miami-based trade finance platform for LatAm exporters, raised $8.2m in equity funding led by Arcadia Funds and a $200m credit facility from MidCap Financial and Castlelake. www.marcofi.com • Cycle, a French collaboration tool for product managers, raised $6m from Boldstart, eFounders, Base Case, 20VC Fund, SV Angel, BoxGroup and Hummingbird Ventures. https://axios.link/3Z8cfwW ⚡ Domatic, an SF-based programmable electrical system for building efficiency, raised $4m in seed funding. Brick & Mortar Ventures led, and was joined by Catapult VC, Alchemist and Third Sphere. www.domatic.io • Trackd, a Reston, Va.-based vulnerability remediation automation startup, raised $3.35m in seed funding. Flybridge led, and was joined by Lerer Hippeau, SaaS Ventures and Expa. www.trackd.com • Inarix, a Paris-based crop analysis platform, raised €3.1m in seed funding from Ankaa ventures, Label Investment, Newfund, Alliance for Impact and Resilience. www.inarix.com • Term Labs, a San Diego-based blockchain R&D startup, raised $2.5m in seed funding. Electric Capital led, and was joined by Coinbase Ventures, Circle Ventures, Robot Ventures and MEXC Ventures. www.termfinance.io • Varo, an SF-based neobank with a national charter, is raising $50m led by Warburg Pincus at a $1.9b valuation (down from $2.5b in mid-2021), per Fintech Business Weekly. https://axios.link/3xX9YIY |     | | | | | | A message from Axios | | The next opportunities across VC, PE and M&A | | |  | | | | Hear directly from top dealmaking professionals and better understand the current market and future of deals across VC, PE, and M&A. Unlock report now. | | | | | | Private Equity Deals | | • Abry Partners invested in Precision Strategies, a New York-based strategy and marketing agency. www.precisionstrategies.com • Bain Capital and KKR are among those progressing to the second round of bidding for Fujitsu General, the air-conditioning unit of Fujitsu (Tokyo: 6702) that could fetch around $1b, per Bloomberg. https://axios.link/3SFIAc4 • Cadrex, a Romeoville, Ill.-based portfolio company of Core Industrial Partners, acquired D&R Machine Co., a provider of CNC precision machining for the aerospace and defense markets. www.cadrex.com • Clayton Dubilier & Rice agreed to buy wealth manager Focus Financial Partners (Nasdaq: FOCS), a New York-based aggregator of wealth management firms, for over $7b. https://axios.link/3Zoykaa • EQT is in talks to buy Radius Global Infrastructure (Nasdaq: RADI), a Bala Cynwyd, Pa.-based cell tower site leasor with a $1.3b market cap, per Bloomberg. https://axios.link/3mhiZK4 🚑 Gentiva, an Atlanta-based hospice company backed by Clayton Dubilier & Rice, agreed to buy the hospice and home care assets of Toledo, Ohio-based nonprofit health care system ProMedica for $720m. https://axios.link/41wJsDS • Hoffmaster Group, an Oshkosh, Wis.-based portfolio company of Wellspring Capital Management, acquired Paterson Pacific Parchment, a Sparks, Nev.-based maker of foodservice paper and parchment products. www.hoffmaster.com • Integrum invested in Strategic Risk Solutions, a Concord, Mass.-based insurance company manager. www.strategicrisks.com • Marco, a portfolio company of Align Capital Partners, acquired Jet Gasket & Seal, a Las Vegas-based maker of O-rings and sanitary gaskets. www.marcorubber.com • PaleoWest, a Phoenix-based portfolio company of The Riverside Company, acquired SEAS, an Ignacio, Colo.-based cultural resource management firm. www.paleowest.com • Thoma Bravo completed its $8b take-private buyout of Coupa Software, a San Mateo, Calif.-based provider of business spend management software. https://axios.link/3Yk1pEa • Trinity Hunt Partners invested in MarksNelson, an Overland Park, Kan.-based accounting, tax and advisory firm. www.mnadvisors.com • Turnspire Capital Partners acquired USG Water Solutions, a Georgia-based provider of water asset management services for small and medium public water utilities, from Veolia North America. |     | | | | | | SPAC Stuff | | • DIH Holding, a provider of robotics and VR tech for the rehab and human performance markets, agreed to go public at a $360m implied equity value via Aurora Technology Acquisition Corp. (Nasdaq: ATAK), a SPAC led by Zachary Wang (Ascan Investments). https://axios.link/41z1cyy • Jet Token, a Las Vegas-based private aviation booking and membership company, agreed to public via Oxbridge Acquisition Corp. (Nasdaq: OXAC). https://axios.link/3Z8hjBc • Nvni Group, a software business acquirer in Latin America, agreed to go public at a $312m implied enterprise value via Mercato Partners Acquisition Corp. (Nasdaq: MPRA), a SPAC formed by Mercato Partners. https://axios.link/3EHC7r5 • PublicSq, an Encinitas, Calif.-based "values-aligned marketplace of pro-America businesses and consumers," agreed to go public via Colombier Acquisition Corp. (NYSE: CLBR), a SPAC led by Omeed Malik. https://axios.link/3mdJArJ • Reverence Acquisition, a fintech SPAC formed by Reverence Capital Partners, withdrew registration for a $300m IPO. https://axios.link/3IZ28oj • SilverBox III, a SPAC formed by SilverBox Capital, raised $120m in its IPO. https://axios.link/3KRef8e |     | | | | | | Liquidity Events | | 🚑 Crescent Capital Partners is seeking a buyer for Healthcare Australia, an Australian health worker recruitment company that could fetch at least A$700m, per Bloomberg. https://axios.link/3KHCKov • Navis Capital Partners is in talks to sell high-end Chinese restaurant chain Imperial Treasure for upwards of US$371m, per Bloomberg. https://axios.link/3YZ44Tv 🚑 Southern Capital Group, a Singapore-based PE firm, is seeking a buyer for Qualitas Health, a Malaysia-based provider of dental and medical care that could fetch around US$300m, per Bloomberg. https://axios.link/41zOkYI |     | | | | | | More M&A | | • The FCC is expected to challenge Intercontinental Exchange's (NYSE: ICE) proposed $13b takeover of mortgage software provider Black Knight (NYSE: BKI), per Politico. https://axios.link/3SA00Xm ⚡ Baytex Energy (TSX: BTE) agreed to buy Ranger Oil (Nasdaq: ROCC), a Houston-based E&P focused on the Eagle Ford shale in South Texas, for $2.5b in cash and stock. https://axios.link/3xZaBSk 🚑 Syneos Health (Nasdaq: SYNH), a Morrisville, N.C.-based biopharma contract research org with a $4.2b market cap, is seeking a buyer, per Reuters. https://axios.link/3YcU0F3 |     | | | | | | Fundraising | | • Bain Capital Ventures raised $1.4b for its latest flagship fund, plus $493m for a new opportunities fund. https://axios.link/3xY5kKJ • Brynwood Partners, a consumer-focused PE firm, raised $500m for its ninth fund, per an SEC filing. • Backswing Ventures, a Florida-based VC firm, is raising $25m for its second fund, per an SEC filing. 🎵 Lyric Capital Group raised $410m for its second music royalty fund, with senior debt financing bringing total deployable capital to over $800m. www.lyriccapitalgroup.com • Oaktree Capital is raising $10b for a private credit fund, per the FT. https://axios.link/41zlbNe |     | | | | | | It's Personnel | | • Cambridge Associates named Harinder Soin as chief data officer and hired Adam Lester (ex-JPMorgan Asset Management) as head of corporate strategy. www.cambridgeassociates.com • Matt Garratt joined USVP as a general partner. He previously was a general partner with CRV and, before that, an executive with Salesforce. https://axios.link/3IXPGoX • General Atlantic named senior adviser Samir Assaf as chairman of the MENA region. www.generalatlantic.com • Sajid Javid, former British Chancellor of the Exchequer, agreed to join Centricus Asset Management as a senior adviser, per Bloomberg. https://axios.link/3m9DWH3 • Randi Moran joined Angeles Equity Partners as chief performance officer. She previously led HR for American Construction Source. www.angelesequity.com • Marcus Bragg (COO, Netlify), Raffael Marty (EVP, ConnectWise) and John Spiliotis (ex-Palo Alto Networks) were named "go-to-market" advisers at Ballistic Ventures. www.ballisticventures.com |     | | | | | | Final Numbers |  Source: Yahoo Finance. Chart: Axios Visuals Goldman Sachs this morning said during an Investor Day presentation that it plans to significantly sell down its alternative assets balance sheet over the next two years, including private equity and real estate. |     | | | | | | A message from Axios | | The next opportunities across VC, PE and M&A | | |  | | | | Hear directly from top dealmaking professionals and better understand the current market and future of deals across VC, PE, and M&A. Unlock report now. | | | | Thanks for reading Axios Pro Rata, and to copy editors Mickey Meece and Bryan McBournie! Please ask your friends, colleagues and Batman to sign up. |  | | Dive deeper into VC, PE and M&A | | | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

To stop receiving this newsletter, unsubscribe or manage your email preferences. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |