| | | | | | | Presented By Uber | | | | Pro Rata | | By Dan Primack ·Feb 28, 2020 | | 🎧 Pro Rata Podcast digs into the practical politics of fracking, ahead of Super Tuesday. Listen here. | | | | | | Top of the Morning |  | | | Illustration: Sarah Grillo/Axios | | | | I really didn't want to write about politics again today, but I also wasn't expecting a leading presidential contender to propose a plan that could upend startup employee compensation. - Driving the news: Sens. Bernie Sanders (D-VT) and Chris Van Hollen (D-MD) introduced legislation that would tax nonqualified stock options at vesting, rather than at exercise, for employees making at least $130,000 per year. The impacts would be felt most by select employees at privately-held companies who'd be taxed on monies that they haven't yet banked.

The legislation, which you can read here, is officially designed to "end tax advantages that allow CEOs to contribute unlimited amounts to special executive retirement plans," with proceeds going to "shore up multi-employer pension plans for 1.7 million workers." Startup employees are collateral damage, much like they would have been had similar language not been stripped from the 2017 tax bill. What to know: - This only applies to employees more than $130,000 per year and vesting more than $100,000 worth of stock per year.

- That means it would be most likely to impact employees at later-stage startups, where the strike prices are higher.

- The proposal doesn't have a grandfather clause, but does include a nine-year transition period (i.e., this wouldn't apply until paying 2029 taxes).

Why it matters is that many of the affected employees, even though well-compensated, may be unable to afford the taxes. - Imagine you make $130,000 per year at a privately-held company and have $200,000 worth of annual options vesting.

- You obviously are required to pay regular taxes on your $130,000 income, but now also must pay taxes on $100,000 worth of stock options (again, the first $100k is excluded).

- Or, put another way, you make $130,000 but are paying taxes on $230,000.

- Not only might you not have the cash, but there's also the possibility that the stock will later go to zero or liquidate lower than your strike price — but the bill includes no claw-back mechanism. So you've now paid taxes on money you never saw.

Tax attorneys tell me that this legislation would likely result in companies shifting more from stock options to restricted stock units (RSUs), and also changing vesting periods to quarterly or yearly (because paying taxes monthly would be an administrative nightmare for both companies and employees). - But there are negative consequences to both: Companies typically provide fewer RSUs than options, because there's no strike price, and longer vesting periods could result in unhappy employees feeling compelled to stick around longer than they otherwise would.

Sources close to the legislation tell me that there could still be tweaks to the language, so don't be surprised if all of this gets addressed. Particularly given that a top Sanders campaign advisor is Rep. Ro Khanna (D-CA), whose district includes such Silicon Valley burgs as Cupertino and Sunnyvale. The bottom line: This isn't how much people pay in taxes. It's about when they pay it. It would make more sense for the timing to match the receipt. |     | | | | | | The BFD |  | | | Illustration: Aïda Amer/Axios | | | | Thyssenkrupp of Germany agreed to sell its elevators unit for $18.7 billion to a consortium that includes Advent International, Cinven, ADIA, and the RAG Foundation. - Why it's the BFD: This is Europe's largest buyout since before the 2008-2009 financial crisis.

- Marketplace: The winning price approximated a bid from Finnish strategic Kone, which was hampered by German labor concerns. It was higher than a rival private equity offer from Blackstone, Carlyle, and CPPIB.

- Bottom line: "Once an emblem of German industrial prowess, Thyssenkrupp is fighting for survival. The company has been bruised by a slowdown in Chinese and German manufacturing, rising pension costs and falling demand for European steel." — Bloomberg

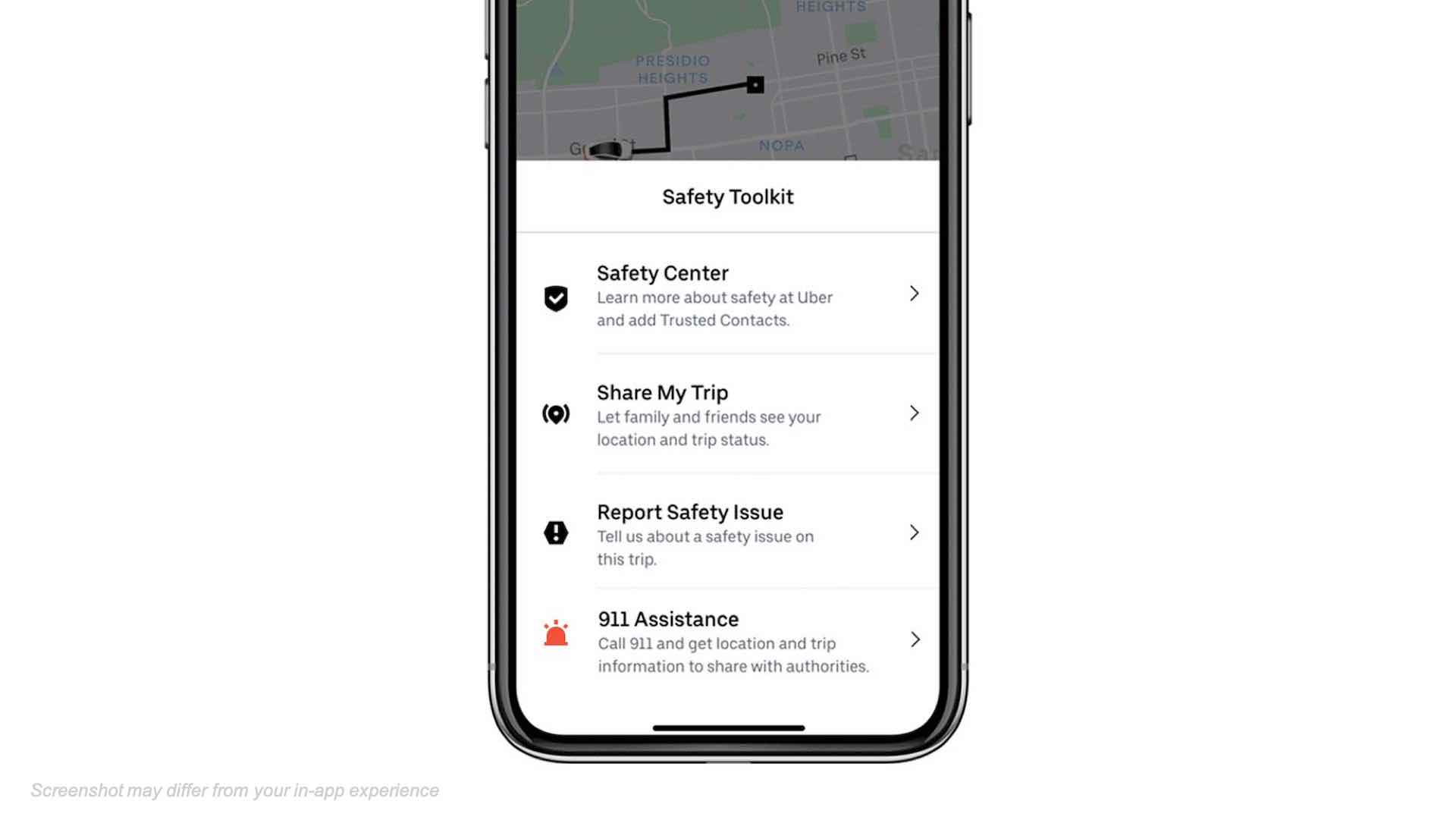

|     | | | | | | Venture Capital Deals | | • Veev, a San Mateo, Calif.-based developer of smart home materials and systems, raised $85 million in equity funding from Zeev Ventures and Lennar Ventures. http://axios.link/jLuP • Lendio, a Lehi, Utah-based small business loans marketplace, raised $55 million in Series E funding. Mercato Partners led, and was joined by Napier Park Financial Partners, Comcast Ventures, Blumberg Capital, Stereo Capital, and Runa Capital. Lendio also secured $24 million in debt from Signature Bank. http://axios.link/uKEP • Tempo, a San Francisco-based connected home fitness system, raised $17.5 million in Series A funding from Founders Fund, Khosla Ventures, DCM, and Bling Capital. http://axios.link/q8Gf 🚑 AxialHealthcare, a Nashville-based healthcare optimization startup focused on substance use issues, raised $15 million from return backers Oak HC/FT, .406 Ventures, BlueeCross BlueShield VP, and Sandbox Advantage Fund. www.axialhealthcare.com |     | | | | | | A message from Uber | | What's coming to Uber's suite of safety tools | | |  | | | | Upgrades coming to Uber's suite of safety tools are designed to help make rides safer by giving riders and drivers the ability to: - Verify rides before you get in with a unique PIN.

- Report a safety incident while on-trip.

- Text 911 directly from the app, where it's supported.

Get more details. | | | | | | Private Equity Deals | | • The Blackstone Group invested in Dealpath, a San Francisco-based provider of real estate investment and portfolio management software. www.dealpath.com • Regions Bank agreed to buy Ascentium Capital, a Kingwood, Texas-based equipment finance lender, from Warburg Pincus. http://axios.link/RJEs |     | | | | | | Public Offerings | | • Lion Air, an Indonesian commercial carrier, is delaying its $500 million IPO plans due to global stock market tumult, per Reuters. http://axios.link/0jvU 🚑 Passage Bio, a Philadelphia-based developer of gene therapies for rare CNS disorders, raised $216 million in its IPO. The company priced 12 million shares at $18, versus original plans to offer 7.4 million shares at $16-$18. It will trade on the Nasdaq (PASG) with JPMorgan as lead underwriter, and had raised around $225 million in VC funding from such firms as OrbiMed (14.9% pre-IPO stake), Versant Ventures (11.3%), Frazier Life Sciences (10.6%), LAV (5.8%), Vivo Ventures (5.3%), and New Lead Ventures (5.3%). www.passagebio.com • ZoomInfo, a Vancouver, Wash.-based data platform for sales, marketing, and recruiting, filed for a $500 million IPO. It plans to trade on the Nasdaq (ZI) with JPMorgan as lead underwriter, and reports a $78 million net loss on $293 million in revenue for 2019. Backers include The Carlyle Group and TA Associates. http://axios.link/bFfu |     | | | | | | Liquidity Events | | • DocuSign (Nasdaq: DOCU) agreed to buy Seal Software, a Walnut Creek, Calif.-based provider of contract discovery and data extraction solutions, for $188 million in cash. Seal had raised nearly $50 million from DocuSign, Toba Capital, Advent Venture Partners, Greylock, and Kreos Capital. http://axios.link/u0M1 • EQT Partners is considering a sale of In.Corp Group, a Singapore-based corporate services provider that could fetch "several hundred million dollars," per Bloomberg. http://axios.link/6HTW |     | | | | | | More M&A | | 🚑 BDMS, Thailand's largest hospital operator, offered $3.2 billion to buy the stake in Bumrungrad Hospital that it doesn't already own. http://axios.link/5dgD 🚑 Gilead Sciences (Nasdaq: GILD) approached Menlo Park-based cancer therapy company Forty Seven (Nasdaq: FTSV) about a possible takeover, per Bloomberg. Forty Seven shares jumped over 30%, giving it a market cap of $2.34 billlion. http://axios.link/F3Fe • Public Storage (NYSE: PSA) is the only remaining bidder for Australian self-storage operator National Storage REIT (ASX: NSR), after both Gaw Capital Partners and Warburg Pincus dropped out. PSA's offer is A$1.89 billion. http://axios.link/rFA7 |     | | | | | | It's Personnel | | • Kate Castle joined Victress Capital, a VC firm focused on female founders, as a partner. She previously was a partner and CMO at Rethink VC. www.victresscapital.com |     | | | | | | Final Numbers | Source: Refinitiv. Data through Feb. 27, 2020. |     | | | | | | A message from Uber | | How Uber's innovative technology is raising the bar on safety | | |  | | | | Uber is committed to your safety, beginning with background checks and ongoing screening for everyone who drives with Uber. And that's just the start. See how Uber improved its Real-Time ID Check to confirm drivers based on how they blink, smile and turn their heads | | | | Thanks for reading Axios Pro Rata! Please ask your friends, colleagues, and startup accountants to sign up. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |